AIP #6: Addendum to Ledger Live Referral Program

Author(s): @adrien part of the Ledger team)

Summary

An addendum to AIP #4: Ledger Live Referral Program to reward Ledger based on user deposits through Ledger Live.

Abstract [What?]

Expand the Ledger Live Referral Program to reward Ledger with Alkemi Network DAO Tokens (ALK) commensurate with user deposits (in addition to borrows) originating from the Ledger Live DApp.

Motivation & Goals [Why?]

The scope AIP #4: Ledger Live Referral Program (Snapshot) included rewarding Ledger based on user borrows via Ledger Live. The goal of this addendum is to create an additional rewarding mechanism to reward Ledger for user deposits as well as borrows. Given Ledger’s market share and user base, Ledger Live integration could facilitate a significant amount of deposits to Alkemi Earn. Even in the case that there is little/no borrow demand on Alkemi Earn from Ledger Live users, Ledger would have still added considerable value by facilitating supply. Therefore, a rewarding mechanism that is based on deposits is proposed to further incentivize Ledger to accelerate Alkemi Earn integration.

Specification & Implementation [How?]

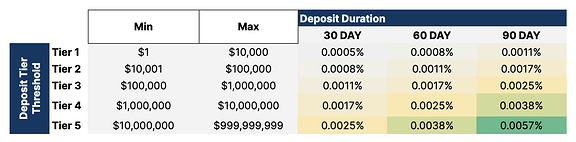

With this program addendum, Ledger would be rewarded in 5 rate tiers based on the amount deposited and duration, with a minimum duration requirement of 30 days. Rewards based on user deposits will be made in Alkemi Network DAO Tokens (ALK) with the following key terms:

-

Payments will be made monthly in ALK on the prior month’s VWAP

-

CoinGecko Data Export will be utilized to calculate the VWAP

-

Same payout methodology will be used for referral payments as for an internal team and contractor ALK payments

The referral mechanism for borrows originating through Ledger Live will also be implemented as described in AIP #4: Ledger Live Referral Program.

If this addendum is accepted, it will be implemented together with AIP #4: Ledger Live Referral Program in two phases, starting from integration and deployment in the ‘Open’ pool, followed by the ‘Verified’ pool implementation in Phase 2.

Vote

-

Yes - Approve the proposal

Yes - Approve the proposal -

No - Do not approve the proposal

No - Do not approve the proposal

0 voters